You need to know the information below before seeking Payroll in Turkey.

Set up a company in Turkey

A foreign company can have an entity with a payroll service provider in Turkey, without establishing a company. But if you want to set-up an entity, please note that the current exchange rate, the need for investors and existing incentives, makes Turkey one of the best places for investment because of its geographical location.

Turkey’s investor-friendly laws are here to increase foreign investments. More and more, Turkish local law is close to Western countries’ practices.

Foreign Direct Investment Law in Turkey, is based on the principle of equal treatment towards international investors, and this makes it possible to have the same rights and obligations as domestic investors.

The conditions for the process of setting up a company and share transfers in a company are the same for foreign investors as for domestic investors. Foreign investors can set up all types of companies listed under the law. The Turkish Commercial Code, together with the new arrangements to meet international standards, to encourage private capital and IPO activities, corporate governance transparency, providing commercial activities and the investment environment in Turkey, all help to bring it in line with European Union legislation.

Bureaucratic procedures to setting up a company have been removed in Turkey, and the cost of setting up a company has been reduced to a minimum. For company organizations, setup is completed in the same day at the Trade Registry Offices.

Payroll Turkey : Most Common Company Types

Limited company

Incorporated company

Guide

Determination of Company Title

Firstly, the company title to be used for the establishment of the company is determined. The company title must indicate at least one of the fields of activity and include the type of company. For example, a limited company that will work in the fields of tourism and construction should have the title of Xyz Tourism Limited Company, Xyz Construction Limited Company, Xyz Tourism and Construction Limited Company etc.

The company title must receive a distinctive supplement from another previously registered company name. If the fields of activity are different, it does not need to receive an annex. To explain with examples:

If the title of Xyz Turizm İnşaat Limited Şirketi has already been registered by another company, Xyz Otomotiv Turizm Limited Company cannot be registered without a distinguished annex.

If the title of Xyz Tourism Construction Limited Company is registered by another company, Xyz Food Textile Limited Company can be registered without a separate supplement.

If the title of Xyz Turizm İnşaat Limited Şirketi is registered by another company, Xyz Turizm İnşaat Anonim Şirketi cannot be registered without a distinctive supplement.

You should inquire whether the name of the company you intend to use, is already used by another company. If you choose a company title that you cannot use as stated above, your registration application will be rejected. By contacting us, we can investigate on your behalf whether the company title you intend to use is appropriate.

It is possible to use foreign words in the company title, provided that the terms indicating the subject of the business and the type of the company are in Turkish. However, a foreigner must be among the shareholders of the company, and the title must be in accordance with the law, general morality, national and cultural interests. For example: Example Tourism Trade Limited Company may be used as a title.

The use of country names in the title will require the permission of the competent authority of that country.

Likewise, Turkey, Turkish, if passed word tradename companies like National, must be approved by the Board of Ministers.

For example; Xyz Turkey Tourism Limited permission is required for the Council of Ministers of the Company.

If you are looking for information regarding Payroll in Turkey, please check our company payroll services.

Determination of Company Type

The type of company you will set up should be one of the companies included in the Commercial Code. In this article, since we include Limited Company and Joint Stock Companies, we will give an explanation for these two types of companies. If you choose a different type of company, you can contact us to get up-to-date information.

Limited company: Company shareholders and their shares are determined. There may be a minimum of 1 and a maximum of 50 partners. The minimum capital amount is TL 10,000. (The requirement to block at least ¼ of the capital before the establishment of the company has been removed.)

Incorporated company: Company shareholders and their shares are determined. It can be established with minimum 5 and maximum 500 partners. The minimum capital amount is 50.000 TL. Before the establishment of the company, at least ¼ of the capital must be blocked. The remaining capital of the company must be completed within at least 24 months following the registration of the company.

Payroll Turkey and Company Formation

Subsequent transactions are similar for both types of companies.

Company’s address of activity is determined. Company manager and representatives are determined. The company’s articles of association are prepared together with this information. The Articles of Association of the Company are notarised. Trade registered transactions and the main contract are sent over the “Mersis” system. Mersis is a system that enables the transactions to be carried out instantly.

After application through Mersis

- Company main agreement

- Notarised signature declaration

- Photocopy of identity card

- Photocopy of passport if the partner is a foreign natural person

- Photocopy of the notarised identity card of company managers

In case the foreign partner is a legal person, the certificate of activity taken from the trade registry of the country in which it is registered (the activity certificate must include the company signature authorities and the current status of the company) the decision of the competent body concerning the name and surname of the natural person representative will take the decision and the letter of assignment.

0.04% of the company’s capital must be paid to the Competition Authority.

Apostille and notarised documents to be signed will be held outside of Turkey, and the parties to the apostille agreement must be approved by the Turkish Consulate. In addition, these documents notarised translation must be done in Turkey.

After the documents are completed, registration application is made to the Trade Registry Office where the company address is located.

As of the date of registration of the Company, the signature circular shall be arranged in the presence of the personnel in the Trade Registry Directorate on behalf of the signature authorities of the company.

After the registration process is completed, the tax registration is opened by applying to the Tax Office where the address is attached, and the tax plate is taken. If the company is to be employed again, registration must be completed at the relevant Social Security Institution.

The books that the company must keep:

The Turkish Commercial Code obliges companies to keep books. During the establishment of the company: Journal, General Ledger, Inventory, Share Book, Board of Directors Decision Book, General Assembly Decision Book are approved by the Trade Registry Directorate.

Further information on the tax and social system in Turkey can be found on the following governmental websites:

Additional information

Liability for company debts

Almost everyone raises the question of whether they will be responsible for the company’s debts. For both companies, the Turkish Commercial Code has adopted the limited liability principle. So; the company is not responsible for the debts of the company, nor is the company responsible for the debts of the partners. However, in limited liability companies, shareholders are responsible for public receivables in proportion to their shares. In the joint stock company, non-members of the board of directors have no responsibility for public debts.

Obligation to work with a lawyer

You must work with a lawyer in joint stock companies whose capital is over 250,000 TL. There is no such obligation for limited companies.

Company establishment costs

The average is between 3,000-4,000 TL and is stated to give you ideas. You can contact us for current costs.

The information mentioned above is specialised. There are no legal obstacles to making your company establishment transactions by yourself. However, while you are focusing on what you will do, we recommend that you work with a lawyer who will represent and guide you through the establishment procedure.

Finally, what is Payroll ?

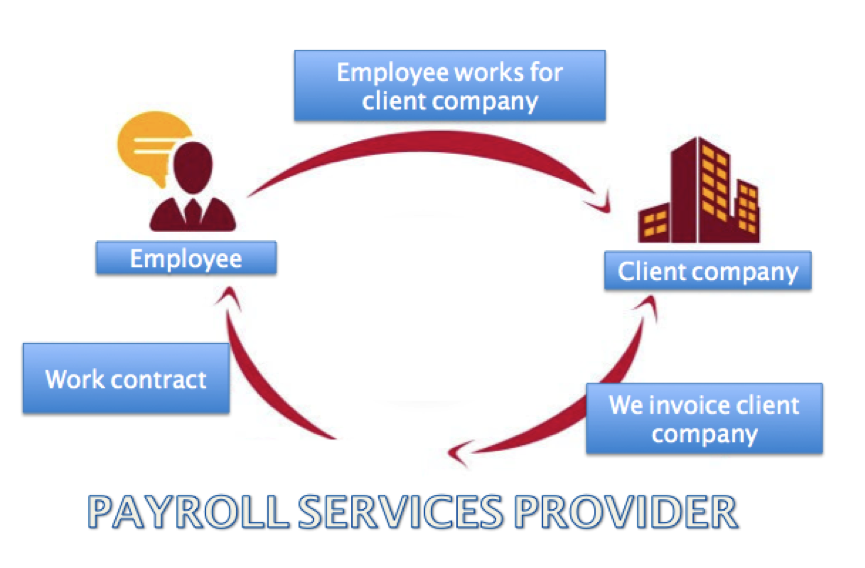

Payroll in Turkey services offered by our company is a solution that allows you to reconcile independence and benefits of employee status.

You develop your consultancy, expert and trainer activity (in the field of intellectual services) in complete autonomy and you entrust your PEO company with the management of your assignments and their invoicing.

You benefit from the advantages of the general scheme for employees (health cover, retirement, welfare and unemployment).

Information about Payroll taxes in Turkey

It is from 1st January to 31st December that the tax year runs in Turkey. We do not need necessary a third party if we want to make any tax behalf of a client.

On the 23rd of the month, the monthly income tax contributions are paid in Turkey.

The Withholding Tax and Monthly Premium Service Document is known as the reporting process for employee income tax. Before the 23rd of the month, this paper has to be submitted.

Regarding social security in Turkey, the contributions have to be declared the 23th of the month. These contributions have to be paid before the next month.

Reporting tax in Turkey needs to be done every month.

The registration of new employees is done the day before starting date. Then, it can be filled online on the SSI registration website.

Documentation required for expat:

Passport

Resident Permit

Photo ID

Diploma

Work contract

Application form

Leavers employee

The termination pay date is not specific. Usually it is detailed on the employment contract. A declaration of departure written by an employee is forwarded by the employer to the authorities. It is better if this is done about 10 days after termination.

Comments are closed